Financial Management AFIN253

Tutorial 11, Week 12

Homework questions.

The option price, also known as the option premium, is paid at the start when the option contract is first agreed to. The buyer (who is long the option) pays the option price to the seller (who is short the option).

The strike price of the option is paid at the end when the option contract matures, assuming that the option ends up being in the money in which case the buyer will exercise. The buyer (who is long the option) pays the option strike price to the seller (who is short the option) at maturity in exchange for the underlying asset if the contract is physically settled. If the contract is cash-settled then the seller will pay the difference between the underlying asset's value and the strike price.

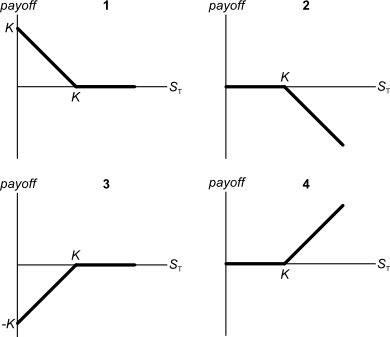

Below are 4 option graphs. Note that the y-axis is payoff at maturity (T). What options do they depict? List them in the order that they are numbered.

Some rules to help remember the way the graphs look:

- Long calls (graph 4) and long puts (graph 1) have a zero or positive payoff at maturity, so their graphs are always above the x-axis (the axis representing the underlying asset's spot price at maturity, ##S_T##). The short option graphs are the symmetric opposite, the graphs are reflected in the x-axis. The payoff is always zero or negative. This makes sense since options, like all derivatives, are a zero sum game: one trader's win is her counterparty's loss.

- The long call graph has a positive payoff if the underlying asset price goes up. It has a positive slope. The long put graph has a positive payoff if the underlying asset price goes down. It has a negative slope.

You have just sold an 'in the money' 6 month European put option on the mining company BHP at an exercise price of $40 for a premium of $3.

Which of the following statements best describes your situation?

You have sold a put option. Therefore you have sold the right for the put option buyer (your counterparty) to sell the underlying BHP share to you at maturity.

This also means that you are have the obligation to buy the underlying BHP share at maturity if the put option buyer exercises and wishes to sell the BHP share to you.

At maturity the put option's underlying asset (the BHP share) can be sold by the long put option trader (your counter-party) from the short put option trader (you). The long option trader will exercise the option if the BHP share price is below the $40 exercise price at maturity. If this happens, you will have to buy a BHP share from the long put option trader.

Which one of the following is NOT usually considered an 'investable' asset for long-term wealth creation?

Options, futures, swaps and other derivatives are primarily used for speculating and hedging, not investing for the long term. This is because derivatives usually have a short maturity, very high leverage and only expose the holder to price fluctuations, not income cash flows including dividends, coupons or rents.

Derivatives are usually used for hedging or speculating rather than investing.

Hedgers seek to reduce risk and are willing to pay for it.

Speculators seek to gain return and are willing to take on risk.

You believe that the price of a share will fall significantly very soon, but the rest of the market does not. The market thinks that the share price will remain the same. Assuming that your prediction will soon be true, which of the following trades is a bad idea? In other words, which trade will NOT make money or prevent losses?

All of the above trades will result in gains or the avoidance of losses except selling put options on the stock. Selling (shorting) put options will result in a positive premium payment at the start, but there will be a negative payoff at maturity if the stock price falls. The long put trader counterparty will exercise her put option to sell the low-value stock at the high exercise price. So the short put trader will be obliged to buy the low-value stock for the high price at maturity, losing money.

Note that shorting futures or forwards will also result in gains from falling prices.

You operate a cattle farm that supplies hamburger meat to the big fast food chains. You buy a lot of grain to feed your cattle, and you sell the fully grown cattle on the livestock market.

You're afraid of adverse movements in grain and livestock prices. What options should you buy to hedge your exposures in the grain and cattle livestock markets?

Select the most correct response:

The cattle farmer has to buy grain and sell cattle. So he is afraid of grain prices going up in the future because then he'll have higher costs. And he is afraid of cattle prices going down in the future since then he will have less revenue.

If grain prices go up, he will lose money and be upset. To make up for this, he should buy call options on grain because they have a positive payoff when grain prices rise. In the event of a grain price increase, the positive cash flow of the long calls will make up for the negative cash flow from the farmer's business, so he will be hedged.

If cattle livestock prices go down, he will lose money and be upset. To make up for this, he should buy put options on cattle because they have a positive payoff when cattle prices fall. In the event of a cattle livestock price decline, the positive cash flow of the long puts will make up for the negative cash flow from the farmer's business, so he will be hedged.

A company runs a number of slaughterhouses which supply hamburger meat to McDonalds. The company is afraid that live cattle prices will increase over the next year, even though there is widespread belief in the market that they will be stable. What can the company do to hedge against the risk of increasing live cattle prices? Which statement(s) are correct?

(i) buy call options on live cattle.

(ii) buy put options on live cattle.

(iii) sell call options on live cattle.

Select the most correct response:

If live cattle prices increase, the slaughterhouse will lose money since it will have higher costs from buying more expensive cattle in the future. Therefore if cattle prices rise, the losses from the business should be offset by gains on options.

Buying call options will result in positive payoffs at maturity if the underlying asset (cattle prices) rise above the exercise price. Buying these options will require the payment of the option price (also called premium) at the start, but since the market believes that cattle prices will remain stable, the price of these call options should be small.

Note that selling put options can also be used to gain from increasing live cattle prices. But this would be a less effective hedge since the gain from selling a put option is only from the premium payment at the start which is fixed. The gain doesn't scale up with the increase in cattle prices, unlike buying calls where the payoff at maturity increases in line with cattle prices.

Suppose that the US government recently announced that subsidies for fresh milk producers will be gradually phased out over the next year. Newspapers say that there are expectations of a 40% increase in the spot price of fresh milk over the next year.

Option prices on fresh milk trading on the Chicago Mercantile Exchange (CME) reflect expectations of this 40% increase in spot prices over the next year. Similarly to the rest of the market, you believe that prices will rise by 40% over the next year.

What option trades are likely to be profitable, or to be more specific, result in a positive Net Present Value (NPV)?

Assume that:

- Only the spot price is expected to increase and there is no change in expected volatility or other variables that affect option prices.

- No taxes, transaction costs, information asymmetry, bid-ask spreads or other market frictions.

This question appears to be simple: the underlying asset's price will rise so buy call options which should have a positive payoff at maturity.

But it's not that simple. Since you and the whole market agree that the milk price will rise by 40%, sellers of call options expect to have to pay the buyers of call options at maturity since the call options are likely to be 'in the money' when the milk price exceeds the call option's strike price.

Therefore sellers will sell their call options for a high price (at the start) to compensate them for the loss they're likely to suffer at maturity (at the end). Using this argument, the NPV of selling and buying call and put options should be zero. There is no positive NPV strategy.

This illustrates the concept that there is 'no free lunch' in an efficient market where everyone has the same information and expectations.